ACH Return Codes

Some times ACH transactions are rejected for few reasons, a returned code is returned to the users in case of failure of the transaction. Most of the bank charges some extra fee on failure of ACH transaction. There are around 60 ACH Return Codes; we are going to talk about some common ACH return reason codes, what it means and why it occurs. ACH transaction is processed through an ACH network in which the originating bank and receiving bank communicate electronically regarding the transaction. In this process the fund may move to the receiver’s bank account or in some case the transaction may be rejected. You can find the NACHA return reason code for a particular transaction listed on the Debit Voucher Report.

Showing posts with label ODFI. Show all posts

Showing posts with label ODFI. Show all posts

What is Automated Clearing House (ACH) | ACH Network | ACH Software

The Automated Clearing House (ACH) is an electronic network which facilitates electronic fund transfers in between various nationalized banks within the United States of America. Rules and regulations of the ACH network is governed by NACHA (National Automated Clearinghouse Association). The network system is extremely efficient and reliable. ACH Software processes bulk quantity of debit and credit transactions in one set.

The ACH network system allows funds electronically debited or credited to a business or personal deposit account. Presently these deposit accounts include checking and savings accounts. During September 2000, ACH credit transactions can be deliver to loan a/c’s and ACH Dr and Cr transactions to Companies general ledger accounts. Automated Clearing House transactions import simple basic information such as the person name (excluding Point-of-Purchase transactions), financial institutes routing number, a/c number, price and the actual date of the transaction. Additional payment information is known as addenda records. The addenda possibly include payment-related details including shipping information or invoice number.

How does Automated Clearing House (ACH) Work?

The ACH network system allows funds electronically debited or credited to a business or personal deposit account. Presently these deposit accounts include checking and savings accounts. During September 2000, ACH credit transactions can be deliver to loan a/c’s and ACH Dr and Cr transactions to Companies general ledger accounts. Automated Clearing House transactions import simple basic information such as the person name (excluding Point-of-Purchase transactions), financial institutes routing number, a/c number, price and the actual date of the transaction. Additional payment information is known as addenda records. The addenda possibly include payment-related details including shipping information or invoice number.

How does Automated Clearing House (ACH) Work?

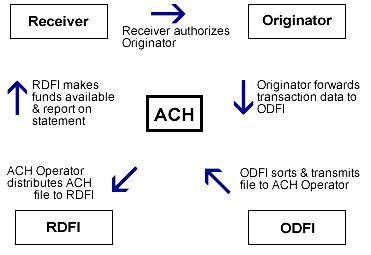

- An organization or a person (Receiver) appoints an organization or a person (Originator) to start a transaction to their financial establishment account.

- The Originator prepares report about the transactions that are to be automated for its buyers or workers and push it to an Originating Depository Financial Institution (ODFI).

- The Originating Depository Financial Institution (ODFI) compiles the Automated Clearing House (ACH) transactions from different organizations, consolidates the report and submits it to the ACH service provider.

- ACH service provider processes transaction files by submitting it to Originating Depository Financial Institutions (ODFIs) and transfer it to Receiving Depository Financial Institutions (RDFIs).

- The RDFI gets entries for its customer accounts and transfers entries on the due date. Transactions are also presented on the account statements.

Subscribe to:

Comments (Atom)