The ACH network system allows funds electronically debited or credited to a business or personal deposit account. Presently these deposit accounts include checking and savings accounts. During September 2000, ACH credit transactions can be deliver to loan a/c’s and ACH Dr and Cr transactions to Companies general ledger accounts. Automated Clearing House transactions import simple basic information such as the person name (excluding Point-of-Purchase transactions), financial institutes routing number, a/c number, price and the actual date of the transaction. Additional payment information is known as addenda records. The addenda possibly include payment-related details including shipping information or invoice number.

How does Automated Clearing House (ACH) Work?

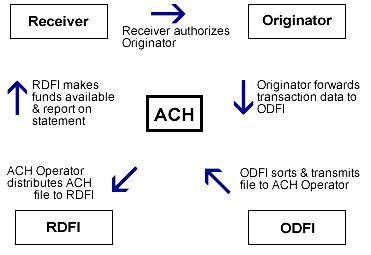

- An organization or a person (Receiver) appoints an organization or a person (Originator) to start a transaction to their financial establishment account.

- The Originator prepares report about the transactions that are to be automated for its buyers or workers and push it to an Originating Depository Financial Institution (ODFI).

- The Originating Depository Financial Institution (ODFI) compiles the Automated Clearing House (ACH) transactions from different organizations, consolidates the report and submits it to the ACH service provider.

- ACH service provider processes transaction files by submitting it to Originating Depository Financial Institutions (ODFIs) and transfer it to Receiving Depository Financial Institutions (RDFIs).

- The RDFI gets entries for its customer accounts and transfers entries on the due date. Transactions are also presented on the account statements.