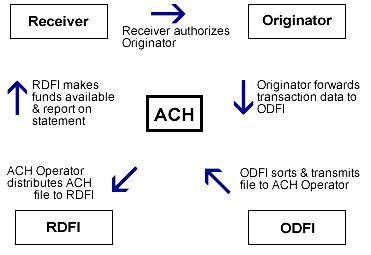

ACH Transfer is also called as Electronic Fund Transfer (EFT). This Automated Clearing House (ACH) processing software is mainly used to transfer large amount of money and bulk number of transaction can be made, because its transfer in very simple and easy method. In this process the account holder of the bank initiate a fund transfer, and then sum of money is deducted from the originator of the transaction and transfer the fund to the destination account.

Both the government and the commercial sectors use ACH payments. Through the ACH Network, businesses, individuals, government organizations and financial institutions deposit, electronically pay, transfer, debit and conduct other financial transactions. The Electronic Payments Network is the only private sector ACH Operator in the United States. ACH Transfers may take longer period typically up to 3 days. But this is the most secured way to transfer funds.

ACH Processing Software Benefits:

1. Large Volume of Transactions

2. Easy and Affordable

3. It's a Pay Simple Method

4. Easy Processing of Checks