NACHA requires that a transaction submitted to the Federal Reserve for processing must include something called a Standard Entry Class (SEC) Code to communicate exactly how the customer gave you authorization to debit/credit their bank account. There are only a few authorization methods allowed by NACHA, so this list of SEC Codes is very short. Below are some common Standard Entry Class (SEC) codes:

Consumer Applications

ARC - Accounts Receivable: This SEC code enables originators to convert checks received via U.S. mailbox location to Single-Entry ACH debits.

CIE - Customer Initiated: This code enables customer to initiate fund transfer, owed to a company, typically from a self-service banking terminal, for example, an automated teller machine, or bill payment service provider.

MTE - Machine Transfer Entry: Fund transfer through automated teller machines (ATM) supports ACH Network for clearing the transactions.

PBR - Consumer Cross Border Payment: Used for international household transactions. For example, foreign exchange conversion, origination and destination currency, country codes, etc.

POP – Point of Purchase: A check presented by the originator to a merchant for purchasing a goods or service, is presented as an ACH debit rather than a physical check.

PPD - Prearranged Payment and Deposit: This SEC code is used to credit or debit a consumer account. Generally used for payroll direct deposits and preauthorize bill payments.

POS - Point of Sale: Swapping of debit or credit card from a network, where a sales transaction occurs.

RCK - Re-presented Check: A physical check that is presented but returned due to insufficient fund in the account holder, this may represent as an ACH entry.

TEL - Telephone-Initiated: This SEC code enables a single entry debit transaction to a consumers account through an oral authorization made by a phone call.

WEB - Internet-Initiated Entry: This SEC code entry enables payment authorization is obtained from the customer via the Internet.

Corporate Applications

CBR - Corporate Cross-Border Payment: This SEC code entry is used for international business transaction. Basically these are used by giant corporate.

CCD - Corporate Credit or Debit: This SEC code entry is used for business-to-business transactions.

CTX - Corporate Trade Exchange: A fund transfer system used by corporate and government institution, to pay trading partners via the automated clearing house (ACH) system. This type of fund transfer allows payment to several parties with a single fund transfer.

Showing posts with label NACHA. Show all posts

Showing posts with label NACHA. Show all posts

ACH Transfer| ACH Credit | What is ACH?

ACH transfer is one of the easiest and quickest ways to transfer money throughout the world. If you are looking for an urgent business payment, ACH transfer is the best way to transfer fund. You can transfer money to every part of the globe without visiting your bank to initiate the transfer.

If you visit a bank to transfer fund you need to stand in a queue in order to initiate a fund transfer. ACH transfer is one of the best ways to transfer money because you can initiate a transfer at your own convenience from home or anywhere else that is convenient for you. All you need to initiate the transfer is a computer with a basic internet connection and an ACH account with a bank or a reputed financial organization.

To transfer fund from your bank account you need to initiate ACH transfer from your online ACH account and request the bank to perform an ACH debit of the amount you want transfer and credit it to the intended receiver’s bank account.

ACH transfer is one of the oldest ways to transfer money since 1970’s and it works as a mediator to transfer money. Generally ACH processing software require 42 to 72 hour to be completed because ACH transaction are done in bulk batch files and the bank will only activate automated clearing house transfer at a fixed a date.

Most of the bank will charge a fee to transfer fund by means ACH transfer, the fee is quite cheaper compare to wire transfer.

If you visit a bank to transfer fund you need to stand in a queue in order to initiate a fund transfer. ACH transfer is one of the best ways to transfer money because you can initiate a transfer at your own convenience from home or anywhere else that is convenient for you. All you need to initiate the transfer is a computer with a basic internet connection and an ACH account with a bank or a reputed financial organization.

To transfer fund from your bank account you need to initiate ACH transfer from your online ACH account and request the bank to perform an ACH debit of the amount you want transfer and credit it to the intended receiver’s bank account.

ACH transfer is one of the oldest ways to transfer money since 1970’s and it works as a mediator to transfer money. Generally ACH processing software require 42 to 72 hour to be completed because ACH transaction are done in bulk batch files and the bank will only activate automated clearing house transfer at a fixed a date.

Most of the bank will charge a fee to transfer fund by means ACH transfer, the fee is quite cheaper compare to wire transfer.

What is an ABA Routing Number?

An ABA (American Bankers Association) Routing Number is a 9 digits code used in the US. This number appears in the bottom of a Cheque, which identify the bank associated with the customer’s bank account. To identify the ABA routing number look at the left corner of the negotiable instrument such as Cheques, deposit slip etc.

The ABA routing number is used by the Federal Reserve Bank to transfer funds and by the ACH to process debit or credit payments and for other Automated Clearing House (ACH) transactions. The ABA routing number is administrated under the sponsorship of the American Bankers Association, which was designed in 1910.

The ABA routing number appears twice on a Cheque i.e. in the fraction form and the MICR (Magnetic Ink Character Recognition) form. Both the forms give the same information but there is a slight difference i.e. MICR form is printed in magnetic ink and it’s readable by machines. Whereas the friction forms are used for manual processing.

Generally MICR form is served as a backup in Cheque processing to prevent it from fraud and other precautionary measures.

The 1st two digits of the 9 digits ABA number must be in the range of 00 through 12, 21 through 32, 61 through 72, or 80.

Rest of all digits is associated as follows:

Sample of ABA Routing Number:

The ABA routing number is used by the Federal Reserve Bank to transfer funds and by the ACH to process debit or credit payments and for other Automated Clearing House (ACH) transactions. The ABA routing number is administrated under the sponsorship of the American Bankers Association, which was designed in 1910.

The ABA routing number appears twice on a Cheque i.e. in the fraction form and the MICR (Magnetic Ink Character Recognition) form. Both the forms give the same information but there is a slight difference i.e. MICR form is printed in magnetic ink and it’s readable by machines. Whereas the friction forms are used for manual processing.

Generally MICR form is served as a backup in Cheque processing to prevent it from fraud and other precautionary measures.

The 1st two digits of the 9 digits ABA number must be in the range of 00 through 12, 21 through 32, 61 through 72, or 80.

Rest of all digits is associated as follows:

- 00 is used by the Government of The United State.

- 01 through 12 are the "normal" routing numbers, and correspond to the 12 Federal Reserve Banks. For example, 0160-0959-3 is the routing number for Bank of America incoming wires in Boston, with the initial "01" indicating the Federal Reserve Bank of Boston.

- 21 through 32 were assigned only to thrift institutions (e.g. credit unions and savings banks) through 1985, but are no longer assigned .

- 61 through 72 are special purpose routing numbers designated for use by non-bank payment processors and clearinghouses and are termed Electronic Transaction Identifiers (ETIs), and correspond to the normal routing number, plus 60.

- 80 is used for traveler's cheques.

Sample of ABA Routing Number:

ACH Fraud Protection Tips

According to the latest cyber crime ACH fraud or Automated Clearing House fraud has been experienced by many banks. An ACH transaction is a payment processed via the ACH Network to transfer funds electronically between bank a/c’s using a batch file processing system. Generally it is used for direct deposit of payroll, social security payments and corporate use it for tax payments to IRS (Internal Revenue Service). All the Rules and regulations of the ACH transactions are governed by NACHA (National Automated Clearinghouse Association).

How ACH Fraud Occurs?

ACH fraud or Automated Clearing House fraud can occur quite easily. An individual may require few details to commit this type of fraud, i.e. your checking account number and your bank routing number. These details are utilized to initiate the fraud. He may use your bank account and routing numbers to make payments by making a phone call to the vendor or through web transactions.

ACH Fraud Protection

One of the easiest ways to get protect from ACH fraud is to install ACH Blocks or ACH Filters on your bank a/c. This type of service is provided by the Bank to its clients to monitor incoming ACH activity. By using this tool you can scrutinized all the transactions. Suspicious transactions are presented directly to you. You can also set restrictions for ACH payments which will control of what payments get authorized.

What can you do if you Detect an ACH Transaction Fraud?

If any ACH Fraud is detected in your bank a/c, then you need to notify your bank within 60 days whereas corporate a/c needs to notify the fraud within 2 days. If you report the fraud within the time frame, then you will not be responsible for the fraud. According to NACHA rules the originating bank must pay compensation to the victim and then try to recover the loss from it’s customer.

One of the best way to prevent ACH fraud is to review and reconciliate your bank statement regularly, whereas corporate accounts must be reviewed daily to avoid fraud.

How ACH Fraud Occurs?

ACH fraud or Automated Clearing House fraud can occur quite easily. An individual may require few details to commit this type of fraud, i.e. your checking account number and your bank routing number. These details are utilized to initiate the fraud. He may use your bank account and routing numbers to make payments by making a phone call to the vendor or through web transactions.

ACH Fraud Protection

One of the easiest ways to get protect from ACH fraud is to install ACH Blocks or ACH Filters on your bank a/c. This type of service is provided by the Bank to its clients to monitor incoming ACH activity. By using this tool you can scrutinized all the transactions. Suspicious transactions are presented directly to you. You can also set restrictions for ACH payments which will control of what payments get authorized.

What can you do if you Detect an ACH Transaction Fraud?

If any ACH Fraud is detected in your bank a/c, then you need to notify your bank within 60 days whereas corporate a/c needs to notify the fraud within 2 days. If you report the fraud within the time frame, then you will not be responsible for the fraud. According to NACHA rules the originating bank must pay compensation to the victim and then try to recover the loss from it’s customer.

One of the best way to prevent ACH fraud is to review and reconciliate your bank statement regularly, whereas corporate accounts must be reviewed daily to avoid fraud.

Advantage of Automated Clearing House & ACH Payment

The Automated Clearing House (ACH) is an electronic network system that helps banks and other commercial institutions to clear electronic payments efficiently. The network operated by the rules and regulations developed by the National Automated Clearing House Association (NACHA). Below are few benefits and advantages of ACH processing:

Get Rid of Paper Checks for Routine Payments

An a/c holder of a bank has to clear his debts on monthly basis or on a specific period of time. Previously he had to issue checks for this proposal. This was tough for the customer as well as for the banker. For processing the paper checks it take lot of time. The a/c holder needs to pay some charges if he issue checks after the due date. Even the bank had to spend some money on petty expenses like postal charges, etc. With the invention of Automated Clearing House (ACH) you can make all the transaction online. All you need to do for the whole process is to send an authorization letter to the bank.

Encourages Financial Management and Facilitates Investment

Automated Clearing House (ACH) is one of the easiest ways to maintain proper financial management and control. If an a/c holder is not having the facilities of an Automated Clearing House he may not have any control over his spending. This system transfers your fund automatically on a specific date. As a result reserved funds are kept for your savings and investment.

Minimize Paperless Operations in Banks

Without Automated Clearing House (ACH) private and public sector banks need to maintain ledgers and other books of a/c to enter all the transaction made in the bank. The banks need to maintain many books of a/c and also need to audit them regularly. By the help of Automated Clearing House (ACH) banks are relieved from all these formalities. This ACH process saves time and money but also error free transactions are made.

Is ACH Right for You?

This option can be selected only if you need to keep some fund reserved for saving or investment for any other purpose. If the fund is not available in you’re a/c during the due date the bankers will impose fine as a penalty. Consequently if you are not sure that you can maintain the fund during the due date, in such case you will need to select the traditional payment method to make sure that you are not at a loss.

Get Rid of Paper Checks for Routine Payments

An a/c holder of a bank has to clear his debts on monthly basis or on a specific period of time. Previously he had to issue checks for this proposal. This was tough for the customer as well as for the banker. For processing the paper checks it take lot of time. The a/c holder needs to pay some charges if he issue checks after the due date. Even the bank had to spend some money on petty expenses like postal charges, etc. With the invention of Automated Clearing House (ACH) you can make all the transaction online. All you need to do for the whole process is to send an authorization letter to the bank.

Encourages Financial Management and Facilitates Investment

Automated Clearing House (ACH) is one of the easiest ways to maintain proper financial management and control. If an a/c holder is not having the facilities of an Automated Clearing House he may not have any control over his spending. This system transfers your fund automatically on a specific date. As a result reserved funds are kept for your savings and investment.

Minimize Paperless Operations in Banks

Without Automated Clearing House (ACH) private and public sector banks need to maintain ledgers and other books of a/c to enter all the transaction made in the bank. The banks need to maintain many books of a/c and also need to audit them regularly. By the help of Automated Clearing House (ACH) banks are relieved from all these formalities. This ACH process saves time and money but also error free transactions are made.

Is ACH Right for You?

This option can be selected only if you need to keep some fund reserved for saving or investment for any other purpose. If the fund is not available in you’re a/c during the due date the bankers will impose fine as a penalty. Consequently if you are not sure that you can maintain the fund during the due date, in such case you will need to select the traditional payment method to make sure that you are not at a loss.

What is Automated Clearing House (ACH) | ACH Network | ACH Software

The Automated Clearing House (ACH) is an electronic network which facilitates electronic fund transfers in between various nationalized banks within the United States of America. Rules and regulations of the ACH network is governed by NACHA (National Automated Clearinghouse Association). The network system is extremely efficient and reliable. ACH Software processes bulk quantity of debit and credit transactions in one set.

The ACH network system allows funds electronically debited or credited to a business or personal deposit account. Presently these deposit accounts include checking and savings accounts. During September 2000, ACH credit transactions can be deliver to loan a/c’s and ACH Dr and Cr transactions to Companies general ledger accounts. Automated Clearing House transactions import simple basic information such as the person name (excluding Point-of-Purchase transactions), financial institutes routing number, a/c number, price and the actual date of the transaction. Additional payment information is known as addenda records. The addenda possibly include payment-related details including shipping information or invoice number.

How does Automated Clearing House (ACH) Work?

The ACH network system allows funds electronically debited or credited to a business or personal deposit account. Presently these deposit accounts include checking and savings accounts. During September 2000, ACH credit transactions can be deliver to loan a/c’s and ACH Dr and Cr transactions to Companies general ledger accounts. Automated Clearing House transactions import simple basic information such as the person name (excluding Point-of-Purchase transactions), financial institutes routing number, a/c number, price and the actual date of the transaction. Additional payment information is known as addenda records. The addenda possibly include payment-related details including shipping information or invoice number.

How does Automated Clearing House (ACH) Work?

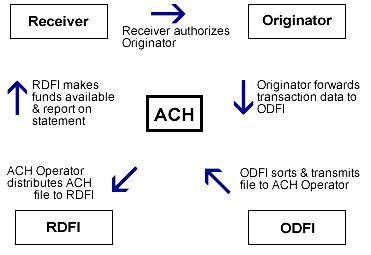

- An organization or a person (Receiver) appoints an organization or a person (Originator) to start a transaction to their financial establishment account.

- The Originator prepares report about the transactions that are to be automated for its buyers or workers and push it to an Originating Depository Financial Institution (ODFI).

- The Originating Depository Financial Institution (ODFI) compiles the Automated Clearing House (ACH) transactions from different organizations, consolidates the report and submits it to the ACH service provider.

- ACH service provider processes transaction files by submitting it to Originating Depository Financial Institutions (ODFIs) and transfer it to Receiving Depository Financial Institutions (RDFIs).

- The RDFI gets entries for its customer accounts and transfers entries on the due date. Transactions are also presented on the account statements.

Subscribe to:

Comments (Atom)