ACH Return Codes

Some times ACH transactions are rejected for few reasons, a returned code is returned to the users in case of failure of the transaction. Most of the bank charges some extra fee on failure of ACH transaction. There are around 60 ACH Return Codes; we are going to talk about some common ACH return reason codes, what it means and why it occurs. ACH transaction is processed through an ACH network in which the originating bank and receiving bank communicate electronically regarding the transaction. In this process the fund may move to the receiver’s bank account or in some case the transaction may be rejected. You can find the NACHA return reason code for a particular transaction listed on the Debit Voucher Report.

Showing posts with label RDFI. Show all posts

Showing posts with label RDFI. Show all posts

What is an ABA Routing Number?

An ABA (American Bankers Association) Routing Number is a 9 digits code used in the US. This number appears in the bottom of a Cheque, which identify the bank associated with the customer’s bank account. To identify the ABA routing number look at the left corner of the negotiable instrument such as Cheques, deposit slip etc.

The ABA routing number is used by the Federal Reserve Bank to transfer funds and by the ACH to process debit or credit payments and for other Automated Clearing House (ACH) transactions. The ABA routing number is administrated under the sponsorship of the American Bankers Association, which was designed in 1910.

The ABA routing number appears twice on a Cheque i.e. in the fraction form and the MICR (Magnetic Ink Character Recognition) form. Both the forms give the same information but there is a slight difference i.e. MICR form is printed in magnetic ink and it’s readable by machines. Whereas the friction forms are used for manual processing.

Generally MICR form is served as a backup in Cheque processing to prevent it from fraud and other precautionary measures.

The 1st two digits of the 9 digits ABA number must be in the range of 00 through 12, 21 through 32, 61 through 72, or 80.

Rest of all digits is associated as follows:

Sample of ABA Routing Number:

The ABA routing number is used by the Federal Reserve Bank to transfer funds and by the ACH to process debit or credit payments and for other Automated Clearing House (ACH) transactions. The ABA routing number is administrated under the sponsorship of the American Bankers Association, which was designed in 1910.

The ABA routing number appears twice on a Cheque i.e. in the fraction form and the MICR (Magnetic Ink Character Recognition) form. Both the forms give the same information but there is a slight difference i.e. MICR form is printed in magnetic ink and it’s readable by machines. Whereas the friction forms are used for manual processing.

Generally MICR form is served as a backup in Cheque processing to prevent it from fraud and other precautionary measures.

The 1st two digits of the 9 digits ABA number must be in the range of 00 through 12, 21 through 32, 61 through 72, or 80.

Rest of all digits is associated as follows:

- 00 is used by the Government of The United State.

- 01 through 12 are the "normal" routing numbers, and correspond to the 12 Federal Reserve Banks. For example, 0160-0959-3 is the routing number for Bank of America incoming wires in Boston, with the initial "01" indicating the Federal Reserve Bank of Boston.

- 21 through 32 were assigned only to thrift institutions (e.g. credit unions and savings banks) through 1985, but are no longer assigned .

- 61 through 72 are special purpose routing numbers designated for use by non-bank payment processors and clearinghouses and are termed Electronic Transaction Identifiers (ETIs), and correspond to the normal routing number, plus 60.

- 80 is used for traveler's cheques.

Sample of ABA Routing Number:

ACH Fraud Protection Tips

According to the latest cyber crime ACH fraud or Automated Clearing House fraud has been experienced by many banks. An ACH transaction is a payment processed via the ACH Network to transfer funds electronically between bank a/c’s using a batch file processing system. Generally it is used for direct deposit of payroll, social security payments and corporate use it for tax payments to IRS (Internal Revenue Service). All the Rules and regulations of the ACH transactions are governed by NACHA (National Automated Clearinghouse Association).

How ACH Fraud Occurs?

ACH fraud or Automated Clearing House fraud can occur quite easily. An individual may require few details to commit this type of fraud, i.e. your checking account number and your bank routing number. These details are utilized to initiate the fraud. He may use your bank account and routing numbers to make payments by making a phone call to the vendor or through web transactions.

ACH Fraud Protection

One of the easiest ways to get protect from ACH fraud is to install ACH Blocks or ACH Filters on your bank a/c. This type of service is provided by the Bank to its clients to monitor incoming ACH activity. By using this tool you can scrutinized all the transactions. Suspicious transactions are presented directly to you. You can also set restrictions for ACH payments which will control of what payments get authorized.

What can you do if you Detect an ACH Transaction Fraud?

If any ACH Fraud is detected in your bank a/c, then you need to notify your bank within 60 days whereas corporate a/c needs to notify the fraud within 2 days. If you report the fraud within the time frame, then you will not be responsible for the fraud. According to NACHA rules the originating bank must pay compensation to the victim and then try to recover the loss from it’s customer.

One of the best way to prevent ACH fraud is to review and reconciliate your bank statement regularly, whereas corporate accounts must be reviewed daily to avoid fraud.

How ACH Fraud Occurs?

ACH fraud or Automated Clearing House fraud can occur quite easily. An individual may require few details to commit this type of fraud, i.e. your checking account number and your bank routing number. These details are utilized to initiate the fraud. He may use your bank account and routing numbers to make payments by making a phone call to the vendor or through web transactions.

ACH Fraud Protection

One of the easiest ways to get protect from ACH fraud is to install ACH Blocks or ACH Filters on your bank a/c. This type of service is provided by the Bank to its clients to monitor incoming ACH activity. By using this tool you can scrutinized all the transactions. Suspicious transactions are presented directly to you. You can also set restrictions for ACH payments which will control of what payments get authorized.

What can you do if you Detect an ACH Transaction Fraud?

If any ACH Fraud is detected in your bank a/c, then you need to notify your bank within 60 days whereas corporate a/c needs to notify the fraud within 2 days. If you report the fraud within the time frame, then you will not be responsible for the fraud. According to NACHA rules the originating bank must pay compensation to the victim and then try to recover the loss from it’s customer.

One of the best way to prevent ACH fraud is to review and reconciliate your bank statement regularly, whereas corporate accounts must be reviewed daily to avoid fraud.

What is Automated Clearing House (ACH) | ACH Network | ACH Software

The Automated Clearing House (ACH) is an electronic network which facilitates electronic fund transfers in between various nationalized banks within the United States of America. Rules and regulations of the ACH network is governed by NACHA (National Automated Clearinghouse Association). The network system is extremely efficient and reliable. ACH Software processes bulk quantity of debit and credit transactions in one set.

The ACH network system allows funds electronically debited or credited to a business or personal deposit account. Presently these deposit accounts include checking and savings accounts. During September 2000, ACH credit transactions can be deliver to loan a/c’s and ACH Dr and Cr transactions to Companies general ledger accounts. Automated Clearing House transactions import simple basic information such as the person name (excluding Point-of-Purchase transactions), financial institutes routing number, a/c number, price and the actual date of the transaction. Additional payment information is known as addenda records. The addenda possibly include payment-related details including shipping information or invoice number.

How does Automated Clearing House (ACH) Work?

The ACH network system allows funds electronically debited or credited to a business or personal deposit account. Presently these deposit accounts include checking and savings accounts. During September 2000, ACH credit transactions can be deliver to loan a/c’s and ACH Dr and Cr transactions to Companies general ledger accounts. Automated Clearing House transactions import simple basic information such as the person name (excluding Point-of-Purchase transactions), financial institutes routing number, a/c number, price and the actual date of the transaction. Additional payment information is known as addenda records. The addenda possibly include payment-related details including shipping information or invoice number.

How does Automated Clearing House (ACH) Work?

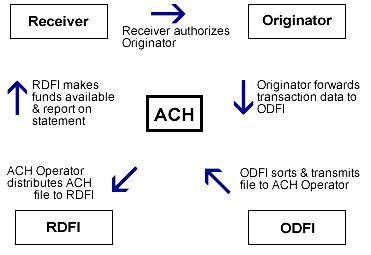

- An organization or a person (Receiver) appoints an organization or a person (Originator) to start a transaction to their financial establishment account.

- The Originator prepares report about the transactions that are to be automated for its buyers or workers and push it to an Originating Depository Financial Institution (ODFI).

- The Originating Depository Financial Institution (ODFI) compiles the Automated Clearing House (ACH) transactions from different organizations, consolidates the report and submits it to the ACH service provider.

- ACH service provider processes transaction files by submitting it to Originating Depository Financial Institutions (ODFIs) and transfer it to Receiving Depository Financial Institutions (RDFIs).

- The RDFI gets entries for its customer accounts and transfers entries on the due date. Transactions are also presented on the account statements.

Subscribe to:

Comments (Atom)